Types Of Life Insurance Explained

Hi I'm Byron you dell founder and CEO of accuquilt since 1986 we've helped.

Illions of people save money on their life insurance when you boil it down there are really only two kinds of life insurance temporary coverage which is called term insurance and permanent insurance both term and permanent life insurance comes in various different shapes and flavors to satisfy different needs a permanent life insurance is designed to provide coverage for as long as you live.

If your needs are long-term like estate planning or final expenses or if you just want to leave a bigger legacy no matter when you die permanent insurance is probably the way to go there are lots of different kinds of permanent insurance but the two primary categories our whole life and universal life and i'll come back to these in a minute term life insurance is by definition temporary insurance.

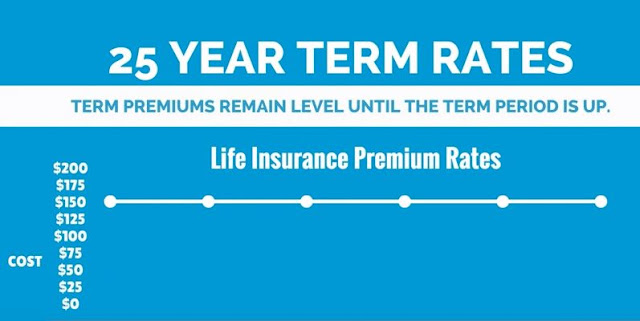

It's designed to provide coverage for a limited period of time typically 10 20 or 30 years term policies are simple and extremely inexpensive in most cases your cost each year is guaranteed to remain level for whatever the term is again typically 10 20 or 30 years after the term is over make sure you're sitting down when you receive your premium notice because your rates are going to jump up dramatically sometimes by a factor of as much as 10.

Or more but some of these policies have a built-in conversion option that allows you to trade in your term coverage for a shiny new permanent policy term life makes sense if you know when you're going to be financially independent or if you're sure there's someday down the road where no one will be depending on you any more financially like when your kids are all grown up and your mortgage is paid off term is also good when you're younger and your biggest concern.

Is getting the protection in place and keeping your costs down if you're a nonsmoker in your thirties and healthy you can buy a 20-year $250,000 term policy for less than twenty dollars a month sound too good to be true well it's a hundred percent true now back to permanent life insurance whole life and universal life insurance.

Are more expensive than term but let's take a look at what you're getting for the money unlike term insurance permanent insurance is generally designed to last forever you can't outlive a permanent life insurance policy with most permanent policies as long as you pay your premiums on time.

Your family is guaranteed to receive the death benefit no matter when you die whether that's tomorrow or 50 years from now unlike term insurance permanent insurance policies can also build cash surrender values which can be accessed at any time for any reason you can set up your premiums to remain level for life guaranteed you won't have to worry about premiums going up when you get older and.

Forcing you to drop the policy nor will you have to worry about being healthy enough in the future to wreak wolluf I or replace the coverage if you like you can also arrange to pay for the policy over a shorter period of time say 10 years so that after that you own the coverage and no further premiums are due for the rest of your life universal life insurance one kind of permanent life insurance offers a.

Certain amount of built-in flexibility you have the ability to change your premiums and death benefits to keep pace with changes in your life whole life insurance is what I refer to as the rolls-royce of life insurance whole life costs more than all the other types of life insurance we've discussed but it does more over time these policies developed significant cash get cash values that are guaranteed and can be accessed at any time regardless of what.

Happens in the economy each year the cash values grow guaranteed what's the best kind of life insurance that's actually a tough question and an easy question different people have different needs if there were really only one best time there would only be one kind I actually own all three types of life insurance we discussed today.

My whole life policy for example i bought 25 years ago I pay 4600 thirty-five dollars each year right now it has a cash surrender value of two hundred seventeen thousand dollars better than a lot of my other investments for sure in the end the best kind of life insurance to own is the kind that's in force on the day you die.

If your policy is not enforced on the day you die you bought the wrong kind for most people the best way to make sure that happens is to own a policy with an affordable level premium for life i hope this quick overview is helpful if you have any questions please dial the number on your screen you'll speak with a real live person with experience with answers and that cares

Thanks for watching yeah.

Illions of people save money on their life insurance when you boil it down there are really only two kinds of life insurance temporary coverage which is called term insurance and permanent insurance both term and permanent life insurance comes in various different shapes and flavors to satisfy different needs a permanent life insurance is designed to provide coverage for as long as you live.

|

| Types Of Life Insurance Explained |

If your needs are long-term like estate planning or final expenses or if you just want to leave a bigger legacy no matter when you die permanent insurance is probably the way to go there are lots of different kinds of permanent insurance but the two primary categories our whole life and universal life and i'll come back to these in a minute term life insurance is by definition temporary insurance.

It's designed to provide coverage for a limited period of time typically 10 20 or 30 years term policies are simple and extremely inexpensive in most cases your cost each year is guaranteed to remain level for whatever the term is again typically 10 20 or 30 years after the term is over make sure you're sitting down when you receive your premium notice because your rates are going to jump up dramatically sometimes by a factor of as much as 10.

Or more but some of these policies have a built-in conversion option that allows you to trade in your term coverage for a shiny new permanent policy term life makes sense if you know when you're going to be financially independent or if you're sure there's someday down the road where no one will be depending on you any more financially like when your kids are all grown up and your mortgage is paid off term is also good when you're younger and your biggest concern.

Is getting the protection in place and keeping your costs down if you're a nonsmoker in your thirties and healthy you can buy a 20-year $250,000 term policy for less than twenty dollars a month sound too good to be true well it's a hundred percent true now back to permanent life insurance whole life and universal life insurance.

|

| Types Of Life Insurance Explained |

Are more expensive than term but let's take a look at what you're getting for the money unlike term insurance permanent insurance is generally designed to last forever you can't outlive a permanent life insurance policy with most permanent policies as long as you pay your premiums on time.

Your family is guaranteed to receive the death benefit no matter when you die whether that's tomorrow or 50 years from now unlike term insurance permanent insurance policies can also build cash surrender values which can be accessed at any time for any reason you can set up your premiums to remain level for life guaranteed you won't have to worry about premiums going up when you get older and.

|

| Types Of Life Insurance Explained |

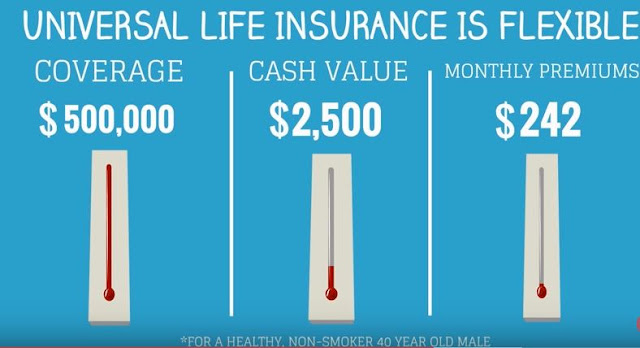

Forcing you to drop the policy nor will you have to worry about being healthy enough in the future to wreak wolluf I or replace the coverage if you like you can also arrange to pay for the policy over a shorter period of time say 10 years so that after that you own the coverage and no further premiums are due for the rest of your life universal life insurance one kind of permanent life insurance offers a.

Certain amount of built-in flexibility you have the ability to change your premiums and death benefits to keep pace with changes in your life whole life insurance is what I refer to as the rolls-royce of life insurance whole life costs more than all the other types of life insurance we've discussed but it does more over time these policies developed significant cash get cash values that are guaranteed and can be accessed at any time regardless of what.

|

| Types Of Life Insurance Explained |

Happens in the economy each year the cash values grow guaranteed what's the best kind of life insurance that's actually a tough question and an easy question different people have different needs if there were really only one best time there would only be one kind I actually own all three types of life insurance we discussed today.

My whole life policy for example i bought 25 years ago I pay 4600 thirty-five dollars each year right now it has a cash surrender value of two hundred seventeen thousand dollars better than a lot of my other investments for sure in the end the best kind of life insurance to own is the kind that's in force on the day you die.

|

| Types Of Life Insurance Explained |

If your policy is not enforced on the day you die you bought the wrong kind for most people the best way to make sure that happens is to own a policy with an affordable level premium for life i hope this quick overview is helpful if you have any questions please dial the number on your screen you'll speak with a real live person with experience with answers and that cares

Thanks for watching yeah.

Types Of Life Insurance Explained

Reviewed by Unknown

on

9:26 AM

Rating:

Reviewed by Unknown

on

9:26 AM

Rating:

Reviewed by Unknown

on

9:26 AM

Rating:

Reviewed by Unknown

on

9:26 AM

Rating:

No comments: