Is whole life insurance worth it?

Hi, my name is Brian Grimes, I'm a senior client service

Manager at PolicyGenius, and I'm a certified financial planner and I'm here to talk to you about to today about whole life insurance. I'm sure this is a type of policy that you've heard of, that maybe you've considered, but what we're going to tell you today are the pros and cons. How these policies are typically presented to you by agents who are out there actively selling them in the marketplace and realistically the cons that they often gloss over that people don't understand.

This is the fine print information that you need to make an educated decision but let's dive right in, so what is whole life insurance? Where did it come from? Well, most people are surprised to find out that whole life insurance has actually been around since the late 1700s, 1780, 1790 in most cases. This is the "belt and suspenders" of life insurance, of the permanent life insurance industry, and it's called that because your grandparents probably had one of these types of

Policies, your parents have probably seen one of these policies, if they don't own them. These policies have been around, but what makes up a whole life insurance policy? Well, one thing is it lasts for your whole life by design, so you don't have to worry about fear that people run into with term life insurance, which is that it's going to expire prematurely, and then I'm going to be essentially uncovered. But whole life insurance can do this because it has a different

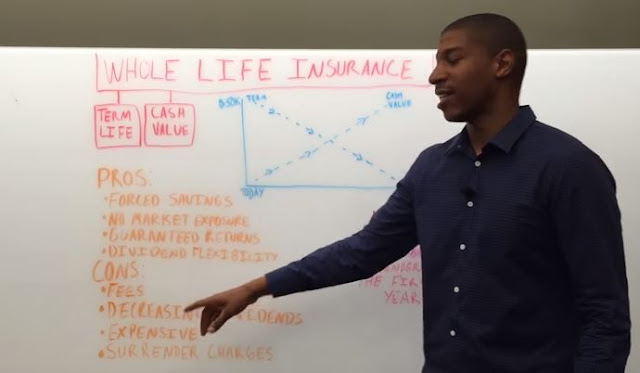

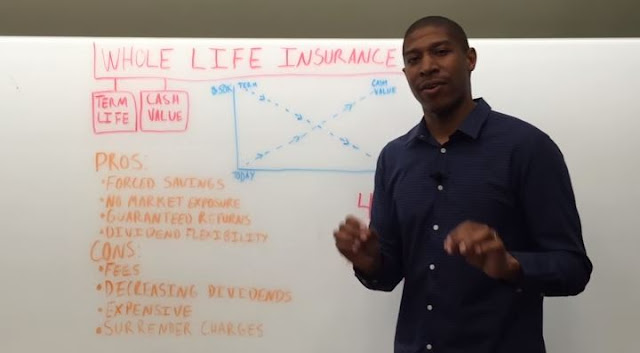

Component that term life insurance doesn't have and that's the cash value component and the cash value is actually comprised of dividends. Now dividends are investment earnings that insurance companies make and then pay back out to insurance policyholders in the form of a cash dividend in most senses. Now this cash dividend will stay inside your policy and it will begin to accumulate a cash value. Now this is representative of your typical whole life insurance policy.

This is simplified for your reason, to make it simpler for you but also because there are hundreds of variations of whole life insurance policies out there, which is why they can be extremely confusing, and why most clients can end up with buyer's remorse at the end of the day as they learn more about these cons and even how some of the pros may be glossed over. And we're going to dive into that but if you look at it, you're going to start with a policy, the term insurance amount of

That policy is going to be higher and this will last for your entire life. This is today but as that cash value accumulates, the amount of term insurance in that policy decreases over time, with your traditional whole life insurance policy and this will result in the later years where you mostly have primarily cash value and very little term insurance left. But just good to keep this in mind so that you understand the different type of structure of a whole life insurance

Policy. Let's dive right into the pros, so what are the pros? How are these policies being pitched to you on the marketplace by the different agents that are out there? Well, here's what you're going to hear in most cases. One, this is the best "forced savings" on the market, best thing since sliced bread, because your typical American is not good at saving, and that is not a surprise especially for the immediate gratification era that we live in today. Forced savings is difficult when

You can online shop, and you can spend money, and take Ubers and different things. It's very hard to save today, and if you think about the typical American, historically most of their nest egg, their wealth, is actually tied up in their real estate because they pay their mortgage every month, and that's a form of fixed savings because you're growing an equity type of value to your asset class. So forced savings, you're going to hear this is a great way to save for retirement.

Now next, no market exposure, this is presented as one of the biggest pros. There's no market exposure here, so if you have money in IRAs and 401ks, you have stocks and bonds, you can use a whole life policy to diversify your asset class, because you don't have market exposure here. You're only exposed to the company's ability to pay that dividend, which is based upon their profitability once again, so you'll hear about this no market exposure, and I'm going to touch on

This again. Guaranteed returns. The guarantees you'll hear about all the time with whole life insurance, they're going to show you guaranteed dividends, and how those dividends are going to grow and create a cash value for you in the future. One thing to know about the guarantees, while it can be a pro, and there are guarantees the illustrations often show you a current illustration. Now current illustrations show you what the dividends are today, and what the fees are today,

And the costs are today and that's current. The guarantees show you the minimum return by law. They don't show you the maximum fees by law and the maximum costs by law, but we'll talk to you about that, but they do show you the guaranteed returns by law and then you have dividend flexibility. This is a good pro because your dividend can be used for a lot of different things. Your dividend can be used to offset your premium costs in the future, so you can use it to reduce

Your future premium. You can use your dividends to receive just cash. You can get an annual check from your dividend. You can also redirect it into your policy to purchase something called paid up additions, so you can use your dividend to purchase more whole life insurance, so you create a bigger policy over time. These are some of the pros and we're going to come back on it. Now what is glossed over by the traditional, typical agent out there?

The fees. Fees, fees, fees. One reason why they may be glossed over is because of the commissions that are racked up in some of these fees, which the agent is receiving, but, with the fees, the fees that you are being shown are current fees. They are not the guaranteed maximum fees that the company can charge you by law and all of this information is -- I won't say hidden -- but it's included in the prospectus of the policy, which is the legalese document of the policy and

These fees can be typically two to three times higher than what is currently being charged. So if you think about it, if your dividend remains the same, and your fee is increase by two to three times, what's going to happen to your cash value? It's going to go way down so keep an eye out for fees and ask about the fee structure, the guaranteed maximum fees. Next on the cons list, is your decreasing dividends. This had been a phenomenon in the life insurance industry as of late,

Really within the last couple of decades. Decreasing dividends have been occurring because insurance companies are not quite as profitable with their permanent products as they once were, because in decreasing interest rate environments, that are lower for longer, which we've been seeing as of the last 10 to 15 years. Life insurance companies don't do as well with their guaranteed products, and the reason why is they're taking money in the form of your premium, and they're

Investing that money into fixed investment so traditionally about 85% of that money is invested in bonds, which these fixed instruments don't give as high of a return in a "lower for longer" interest rate environment. Which means your dividend will decrease and it already has been, so if you own a whole life policy currently... Go back and take a look at the first illustration that was shown to you when you purchased the policy and look at the dividend that you're being

Given today and the cash value that you have today. It's decreased already and will continue most likely. Next, you have the expenses. These policies are typically one and a half to two times as expensive as your typical permanent life insurance policy, so it's more expensive than your variable universal life policy, your index universal life policy, your UL. This is the most expensive type of permanent life insurance available on the market, and

Once again those expenses come in the form of fees and commissions that are being paid out to agents so definitely ask about the expenses. Know what the guaranteed maximum expenses and fees are by law, because the chances are that if the insurance company gets in trouble and rates stay lower for longer, you could be paying higher expenses and fees than you initially anticipated. Last, we have surrender charges, and this is what trips people up when they think about

Another pro that can be presented is, "Hey, this is a slightly liquid investment you can access this money before you turn 59 and a half, which is better than your 401k or your IRA." Well, there is a very limited liquidity here in the form of a surrender charge. These are charges that you're forced to pay if you decide, "You know what, I've had enough with this policy, I haven't seen a return. It's been 5, 10 years. I just want to, you know, get out of this investment and walk away. Well, before you walk away, the company, it is going to take a surrender charge, which can be a very hefty fee. It can be thousands if not tens of thousands of dollars, so you want to know the surrender charges. What they are, how long they are. They're typically 10, 15, 20 years and they start off high and decrease over time, which means if you surrender your policy within the first 10 years you're going to be paying the highest surrender charges available within

That contract, so make sure you understand this fine print. Going back over the pros, things that are glossed over, we already talked about... Yes, it's a forced savings but is it really better than your 401k or IRA, depending on your age, if you have these surrender charges and you want to walk away? No market exposure. I just told you, you don't have direct stock or bond market exposure per se, but you are exposed to this one company, so if you think about it, think about diversification, and what your financial adviser would tell you. They're going to tell you, "Hey, if you want to invest money, you go and you put money in a mutual fund." Why? because there are hundreds of stocks, if not thousands of stocks and bonds in that mutual fund. You're going to be well diversified and that's the way to go. Well, what are you doing when you're investing in a whole life insurance policy? Aren't you really

Taking your money and exposing yourself to just one company? Is that any different than taking all of your money and buying one stock and hoping for the best? This is complete lack of diversification if you think about it, so although you might be diversifying your asset class, versus stocks and bonds, or real estate, insurance. There's not much diversity in the form of your return and that's something that should concern you. The guaranteed returns, we talked about and,

The dividend flexibility, once again, I do like this, but it's not as attractive when you have the decreasing dividends that have been taking place lately. One stat to leave you with, 45% of people who buy these whole life policies, they actually surrendered these policies within the first 10 years and once again, I told you that's when the surrender charges are the absolute highest, so you have to understand this fine print. The pros are typically presented to you.

TheCons are quickly glossed over. The commissions are never discussed in most cases, but you want to be aware of these things, so that you're better informed in making the best decision for you and lastly, what do the experts think? Forget, you know, what I think. I mean, I'm giving you everything I have here, but what do the other experts think? Well, Dave Ramsey is an expert. He talks about financial advisory topics, life insurance and one thing he says about.

Whole life insurance is, "It's one of the worst financial products on the market," according to Dave Ramsey. He will pound the table on that. Suze Orman, I'm sure many of you have watched her and heard about her. What she says is this is on her list of "Forever Nevers." Never will she buy a whole life insurance policy, according to Suze Orman, and lastly, we have Clark Howard. He has a broad reach to a lot of different clients and prospects out there who have these types of

policies.

He calls whole life insurance, "A simple formula for failure," so that's what they think. Here's what I think, but what do you think? Feel free to leave a comment on the video below. Reach out to us, policygenius.com. You can reach out with a phone call, you can ask one of our experts. We're happy to help with anything at all, but go out, do you research, understand the pros, understand what's being glossed over, read the prospectus, read the fine print and reach

Out to us. We're happy to help and thanks for your time.

Manager at PolicyGenius, and I'm a certified financial planner and I'm here to talk to you about to today about whole life insurance. I'm sure this is a type of policy that you've heard of, that maybe you've considered, but what we're going to tell you today are the pros and cons. How these policies are typically presented to you by agents who are out there actively selling them in the marketplace and realistically the cons that they often gloss over that people don't understand.

This is the fine print information that you need to make an educated decision but let's dive right in, so what is whole life insurance? Where did it come from? Well, most people are surprised to find out that whole life insurance has actually been around since the late 1700s, 1780, 1790 in most cases. This is the "belt and suspenders" of life insurance, of the permanent life insurance industry, and it's called that because your grandparents probably had one of these types of

|

| Is whole life insurance worth it? |

Policies, your parents have probably seen one of these policies, if they don't own them. These policies have been around, but what makes up a whole life insurance policy? Well, one thing is it lasts for your whole life by design, so you don't have to worry about fear that people run into with term life insurance, which is that it's going to expire prematurely, and then I'm going to be essentially uncovered. But whole life insurance can do this because it has a different

Component that term life insurance doesn't have and that's the cash value component and the cash value is actually comprised of dividends. Now dividends are investment earnings that insurance companies make and then pay back out to insurance policyholders in the form of a cash dividend in most senses. Now this cash dividend will stay inside your policy and it will begin to accumulate a cash value. Now this is representative of your typical whole life insurance policy.

This is simplified for your reason, to make it simpler for you but also because there are hundreds of variations of whole life insurance policies out there, which is why they can be extremely confusing, and why most clients can end up with buyer's remorse at the end of the day as they learn more about these cons and even how some of the pros may be glossed over. And we're going to dive into that but if you look at it, you're going to start with a policy, the term insurance amount of

|

| Is whole life insurance worth it? |

That policy is going to be higher and this will last for your entire life. This is today but as that cash value accumulates, the amount of term insurance in that policy decreases over time, with your traditional whole life insurance policy and this will result in the later years where you mostly have primarily cash value and very little term insurance left. But just good to keep this in mind so that you understand the different type of structure of a whole life insurance

Policy. Let's dive right into the pros, so what are the pros? How are these policies being pitched to you on the marketplace by the different agents that are out there? Well, here's what you're going to hear in most cases. One, this is the best "forced savings" on the market, best thing since sliced bread, because your typical American is not good at saving, and that is not a surprise especially for the immediate gratification era that we live in today. Forced savings is difficult when

You can online shop, and you can spend money, and take Ubers and different things. It's very hard to save today, and if you think about the typical American, historically most of their nest egg, their wealth, is actually tied up in their real estate because they pay their mortgage every month, and that's a form of fixed savings because you're growing an equity type of value to your asset class. So forced savings, you're going to hear this is a great way to save for retirement.

Now next, no market exposure, this is presented as one of the biggest pros. There's no market exposure here, so if you have money in IRAs and 401ks, you have stocks and bonds, you can use a whole life policy to diversify your asset class, because you don't have market exposure here. You're only exposed to the company's ability to pay that dividend, which is based upon their profitability once again, so you'll hear about this no market exposure, and I'm going to touch on

This again. Guaranteed returns. The guarantees you'll hear about all the time with whole life insurance, they're going to show you guaranteed dividends, and how those dividends are going to grow and create a cash value for you in the future. One thing to know about the guarantees, while it can be a pro, and there are guarantees the illustrations often show you a current illustration. Now current illustrations show you what the dividends are today, and what the fees are today,

|

| Is whole life insurance worth it? |

And the costs are today and that's current. The guarantees show you the minimum return by law. They don't show you the maximum fees by law and the maximum costs by law, but we'll talk to you about that, but they do show you the guaranteed returns by law and then you have dividend flexibility. This is a good pro because your dividend can be used for a lot of different things. Your dividend can be used to offset your premium costs in the future, so you can use it to reduce

Your future premium. You can use your dividends to receive just cash. You can get an annual check from your dividend. You can also redirect it into your policy to purchase something called paid up additions, so you can use your dividend to purchase more whole life insurance, so you create a bigger policy over time. These are some of the pros and we're going to come back on it. Now what is glossed over by the traditional, typical agent out there?

The fees. Fees, fees, fees. One reason why they may be glossed over is because of the commissions that are racked up in some of these fees, which the agent is receiving, but, with the fees, the fees that you are being shown are current fees. They are not the guaranteed maximum fees that the company can charge you by law and all of this information is -- I won't say hidden -- but it's included in the prospectus of the policy, which is the legalese document of the policy and

These fees can be typically two to three times higher than what is currently being charged. So if you think about it, if your dividend remains the same, and your fee is increase by two to three times, what's going to happen to your cash value? It's going to go way down so keep an eye out for fees and ask about the fee structure, the guaranteed maximum fees. Next on the cons list, is your decreasing dividends. This had been a phenomenon in the life insurance industry as of late,

Really within the last couple of decades. Decreasing dividends have been occurring because insurance companies are not quite as profitable with their permanent products as they once were, because in decreasing interest rate environments, that are lower for longer, which we've been seeing as of the last 10 to 15 years. Life insurance companies don't do as well with their guaranteed products, and the reason why is they're taking money in the form of your premium, and they're

Investing that money into fixed investment so traditionally about 85% of that money is invested in bonds, which these fixed instruments don't give as high of a return in a "lower for longer" interest rate environment. Which means your dividend will decrease and it already has been, so if you own a whole life policy currently... Go back and take a look at the first illustration that was shown to you when you purchased the policy and look at the dividend that you're being

Given today and the cash value that you have today. It's decreased already and will continue most likely. Next, you have the expenses. These policies are typically one and a half to two times as expensive as your typical permanent life insurance policy, so it's more expensive than your variable universal life policy, your index universal life policy, your UL. This is the most expensive type of permanent life insurance available on the market, and

Once again those expenses come in the form of fees and commissions that are being paid out to agents so definitely ask about the expenses. Know what the guaranteed maximum expenses and fees are by law, because the chances are that if the insurance company gets in trouble and rates stay lower for longer, you could be paying higher expenses and fees than you initially anticipated. Last, we have surrender charges, and this is what trips people up when they think about

Another pro that can be presented is, "Hey, this is a slightly liquid investment you can access this money before you turn 59 and a half, which is better than your 401k or your IRA." Well, there is a very limited liquidity here in the form of a surrender charge. These are charges that you're forced to pay if you decide, "You know what, I've had enough with this policy, I haven't seen a return. It's been 5, 10 years. I just want to, you know, get out of this investment and walk away. Well, before you walk away, the company, it is going to take a surrender charge, which can be a very hefty fee. It can be thousands if not tens of thousands of dollars, so you want to know the surrender charges. What they are, how long they are. They're typically 10, 15, 20 years and they start off high and decrease over time, which means if you surrender your policy within the first 10 years you're going to be paying the highest surrender charges available within

That contract, so make sure you understand this fine print. Going back over the pros, things that are glossed over, we already talked about... Yes, it's a forced savings but is it really better than your 401k or IRA, depending on your age, if you have these surrender charges and you want to walk away? No market exposure. I just told you, you don't have direct stock or bond market exposure per se, but you are exposed to this one company, so if you think about it, think about diversification, and what your financial adviser would tell you. They're going to tell you, "Hey, if you want to invest money, you go and you put money in a mutual fund." Why? because there are hundreds of stocks, if not thousands of stocks and bonds in that mutual fund. You're going to be well diversified and that's the way to go. Well, what are you doing when you're investing in a whole life insurance policy? Aren't you really

Taking your money and exposing yourself to just one company? Is that any different than taking all of your money and buying one stock and hoping for the best? This is complete lack of diversification if you think about it, so although you might be diversifying your asset class, versus stocks and bonds, or real estate, insurance. There's not much diversity in the form of your return and that's something that should concern you. The guaranteed returns, we talked about and,

The dividend flexibility, once again, I do like this, but it's not as attractive when you have the decreasing dividends that have been taking place lately. One stat to leave you with, 45% of people who buy these whole life policies, they actually surrendered these policies within the first 10 years and once again, I told you that's when the surrender charges are the absolute highest, so you have to understand this fine print. The pros are typically presented to you.

TheCons are quickly glossed over. The commissions are never discussed in most cases, but you want to be aware of these things, so that you're better informed in making the best decision for you and lastly, what do the experts think? Forget, you know, what I think. I mean, I'm giving you everything I have here, but what do the other experts think? Well, Dave Ramsey is an expert. He talks about financial advisory topics, life insurance and one thing he says about.

Whole life insurance is, "It's one of the worst financial products on the market," according to Dave Ramsey. He will pound the table on that. Suze Orman, I'm sure many of you have watched her and heard about her. What she says is this is on her list of "Forever Nevers." Never will she buy a whole life insurance policy, according to Suze Orman, and lastly, we have Clark Howard. He has a broad reach to a lot of different clients and prospects out there who have these types of

policies.

He calls whole life insurance, "A simple formula for failure," so that's what they think. Here's what I think, but what do you think? Feel free to leave a comment on the video below. Reach out to us, policygenius.com. You can reach out with a phone call, you can ask one of our experts. We're happy to help with anything at all, but go out, do you research, understand the pros, understand what's being glossed over, read the prospectus, read the fine print and reach

Out to us. We're happy to help and thanks for your time.

Is whole life insurance worth it?

Reviewed by Unknown

on

9:40 AM

Rating:

Reviewed by Unknown

on

9:40 AM

Rating:

Reviewed by Unknown

on

9:40 AM

Rating:

Reviewed by Unknown

on

9:40 AM

Rating:

whole of life insurance policy is the right policy to protect your family when unexpected situation occurs. The coverage will be for whole life and acts as a financially backup to your dependents.

ReplyDelete